Upcoming Events

Shown in chronological order

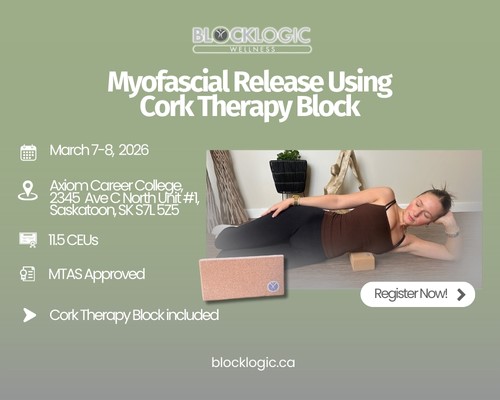

Block Logic Workshop

Saskatoon, SK

One Powerful Tool. Endless Myofascial Benefits.

Reduce strain on your hands.

Expand your treatment options.

Teach clients effective self-care.

Join this two-day, CEU-approved, in-person workshop and learn how to integrate a cork therapy block into myofascial release with confidence and clinical clarity.

Myofascial Release Using a Cork Therapy Block introduces therapists to Block Logic, a practical, fascia-conscious approach designed to support sustainable careers and better therapeutic outcomes.

This hands-on course blends:

- Clear, applicable fascia theory

- Instructor-guided demonstrations

- Practical techniques you can use immediately in treatment sessions

You’ll gain tools to identify fascial restrictions, apply targeted MFR techniques, and expand your clinical skill set while reducing repetitive strain on your hands.

What you’ll walk away with

- A working understanding of fascia and myofascial release principles

- Practical cork therapy block techniques for common restriction patterns

- Strategies to integrate block-based MFR into full sessions or treatment plans

- Client-ready self-care techniques that support long-term results

- Approaches that support therapist longevity and career sustainability

TREAT. TEACH. THRIVE.

Course Details

Dates: March 7–8, 2026

Location: Axiom Career College, Saskatoon, SK

Format: Lecture, demonstration, and hands-on practice

Duration: 2 full days (9:00 AM – 4:00 PM)

CEUs: 11.5 credits

MTAS Approved

Certificate of completion provided

Included: Cork Therapy Block

Space is limited to support focused, hands-on learning.

Beginner Level 2 Shiatsu Massage

Saskatoon, SK

Beginner Level 1 and/or Level 2 Shiatsu Classes

Level 1: Sunday, January 25th - 9:30am-3:00pm

Level 2: Sunday, March 8th - 9:30am - 3:00pm

$200.00 (tax incl.) per person per class

KOU-DO SHIATSU Japanese Healing Therapy

Shiatsu is a Japanese healing art in which finger pressure is used on tsubos (pressure points) on the body to normalize body function, relieve pain and tension, and increase the function of the body's organs to maintain and improve health. Shiatsu is one of the best health care methods in daily life that can treat and help prevent illness.

Shiatsu can relieve symptoms of:

● Arthritis

● Asthma

● Fatigue

● Migraine headaches

● Tight shoulders

● Menopause

● Indigestion

● Lower back pain

● Insomnia

● And many more conditions

These workshops are presented by Saskatoon's Shiatsu Master Yuki Sugimoto of the Saskatoon Shiatsu Centre and Training Institute. The Shiatsu Massage Training Institute is the only one of its kind in Saskatchewan. Master Sugimoto has 20 years experience teaching Shiatsu.

Bring 2 pillows and towels, lunch and a snack.

Class size: maximum 10 participants.

**No spaces saved without payment in full**

Credits: 6 primary per level.

For more information phone Yuki: 306-477-1460.

Class location: #7 - 1702 Alexandria Avenue, Saskatoon.

Please mail registration fee to:

Yuki Sugimoto, 102 Simon Fraser Crescent, Saskatoon, S7H 3T1

Mental Health First Aid (MHFA) -Standard (Virtual)

Online

Mental Health First Aid is a globally recognized training - delivered virtually - that empowers everyday people to recognize when someone may be experiencing mental health challenges and equips them with practical skills to provide initial support. This course builds confidence to respond calmly and offer meaningful help during tough moments—all without needing to be a mental health expert.

Mental Health First Aid Supporting Youth is a globally recognized training - delivered virtually - that equip participants to provided help to a young person who is navigating mental health challenges with understanding and support.

As a Mental Health First Aiders, you will develop:

Peace of Mind: You’ll be better able to help if someone around you, like a friend or coworker, is having a hard time. You’ll feel prepared and confident to step in and offer initial support.

Practical Skills: You’ll be equipped with simple, actionable steps to provide support until the person can access professional help if needed.

Easier Dialogue: It helps you handle brave conversations without feeling awkward or worried you’ll say the wrong thing.

Stronger Connections: By recognizing when someone may need support, you’ll become a more compassionate friend, partner, or family member.

Topics covered include (detailed course outline is attached):

Mental health first aid actions for declining mental well-being.

Mental health first aid actions for crisis and emergency situations, including suicidal thoughts and behaviours, panic attacks, psychotic states and traumatic events.

Self-care for the first aider.

Upcoming MHFA course dates (virtual):

• March 9, 2026 (8:30AM – 4:00PM CST) - 2 seats available

• March 25, 2026 (8:30AM – 4:00PM CST) - 7 seats available

Upcoming MHFA Supporting Youth course dates (virtual):

• March 4 & 5, 2026 (12:30PM – 4:30PM CST) - 13 seats available

Cost? $300 plus 5% GST = $315 per participant

Ready to register? Registration is quick and easy via our website.

9 primary credits for MTAS members

Beyond the Basics: Growing with Social Media

Online

Beyond the Basics: Growing with Social Media

Mar 12, 2026·10:00am - 11:00am

Hosted by Community Futures

Breast and Chest Massage Therapy Class with Pam Fichtner, RMT/CDT Therapist

Saskatoon, SK

Breast and Chest Massage Therapy with Pam Fichtner, RMT/CDT

Dates: Sat and Sun, March 14 and 15, 2026

Time: 9:00 to 5:00 (1 hour for lunch)

Location: MTAS office - #22- 1738 Quebec Avenue, Saskatoon

Credits: 14 primary credits

For pricing and to register: e-mail Pam Fichtner at sephira@sasktel.net

WHY? Breast and Chest Massage Therapy is used to maintain and promote healthy breast tissue as well as a recovery treatment. It can reduce sensitivity and pain, decrease muscle tension in the area, improve upper body range of motion, and reduce scar tissue. Specific areas when it is indicated are: General Breast and Chest Health, Pregnancy and Breastfeeding issues, Breast Reduction, Breast Enlargement, Implants/Explants, Breast Cancer- Pre/Post surgery- Lumpectomy and Mastectomy, Breast Reconstruction and Gender Affirming Top Surgery.

HOW? It consists of specific techniques applied to the soft tissue of the breast or chest area to increase blood and lymphatic flow, which will be explained and applied in class.

WHO? All clients are indicated to receive breast and chest massage therapy-women, non-binary and trans people and men who feel they can benefit from it. Also, in all age stages of life - youth, mothers, midlife and elders and different populations - menstruating women, pregnant women, breastfeeding women, breast cancer clients and people in recovery from gender-affirming top surgery.

WHEN? Indications- reduce pain, inflammation, swelling, increase movement etc.

WHAT? Basic techniques-massage therapy, lymphatic drainage-basic techniques, scar tissue release, home care and educational material on breast health.

WHERE? It can be provided in massage therapy treatment rooms, at a client’s home or in the hospital or care home.

The class includes:

- Anatomy and Physiology Review

- Therapeutic Relationship Importance-trauma informed

- Benefits vs Risks, Indications and Contraindications

- Benign and Cancer-related conditions

- Clinical Applications of Breast Massage Therapy

- Scenarios and Case Studies

- Home Care

- Breast Health Educational Material

Pam Fichtner, RMT, has been practising for over 25 years, with a focus on women’s health, in particular, breast massage therapy and breast health education. She loves teaching this class and sharing her knowledge with students. The material has been updated and will be sent in a new format with modules to read ahead of time. Go to the new website, sephirahealing.ca for more information about Pam and her classes.

Your Digital Welcome Mat- Building a Landing Page

Online

Your Digital Welcome Mat: Building a Landing Page

Mar 19, 2026·10:00am - 11:00am

Hosted by Community Futures

Craniosacral Therapy and Therapeutic Process Techniques

Saskatoon, SK

Align Alive Academy Craniosacral Therapy and Therapeutic Process Techniques training

Saskatoon CSFT1/CSTMT1 - Mar 19-22

Edmonton CSFT1/CSTTPT2 - June 11-14

Saskatoon CSFT 1/CSTTPT 1 - July 16-19

Manitou Beach, SK CSFT1/CSTTPT2 - Sept 3-6

Location TBA CSFT/CSTTPT3 - Nov 19-22

For more information: www.drzubin.com/classe

EVENT CANCELLED - IASTM with Dr. Nikita Vizniak

Seven Oaks Hotel, Regina

More information and registration here.

Registration deadline is February 26th.

Minimum 12 people required; maximum 30 people.

All fees shown on online registration form page are subject to GST.

Registration fees including GST:

- MTAS members: $375

- Non-MTAS: $425

- Students: $225 (applies to those who are student members of MTAS at the time of the workshop)

Method of payment:

- Visa and MasterCard via the built-in online payment tool.

- E-transfer to payment@saskmassagetherapy.com (direct/auto deposit only, no security question).

Credits and hours:

- 7 primary credits per day.

- 8:30am - 5pm each day. 1-hour lunch and 2 stretch breaks. No food and beverage services are provided.

Registration fee includes two complimentary textbooks: Joint Play and IASTM by Dr. Vizniak.

Instrument sets are normally $600 online, but $400 at the course - bring your credit card!

About the Instructor:

See Dr. Nik's full bio here: https://www.prohealthsys.com/about/dr-nikita-vizniak/

Dr. Nikita Vizniak (aka ‘Dr. Nik’), BSc, DC, ERYT, RMT, CES is a collection of ~214 bones, ~472 joints, and soft tissues that loves to learn, teach and help people reach their optimal potential.

He is an author, clinician and professor of clinical cadaver anatomy, exercise therapy, orthopedics, joint mobilizations, and a globally recognized subject matter expert. He is certified by the National Academy of Sports Medicine as a Corrective Exercise Specialist, practitioner at prohealthclinics.com and has authored many textbooks, YouTube videos and CE courses used around the world; including the best-selling Muscle Manual and Orthopedic Assessment, among others. His works have been translated into many languages and help millions of students, clinicians and instructors promote evidence-based, best practices of multidisciplinary patient-centered care.

Dr. Nik loves teaching and empowering people with results-based practical content – anatomy is the foundation of his work, progressing to assessment and action. His motto – ‘We are all students and life is cumulative – work smarter not harder and have fun. #sayitwithasmile’ Follow him on FB, IG or YouTube.

INTRODUCTION TO IASTM

Click here to watch videos explaining IASTM:

https://www.youtube.com/watch?v=65e-mp3Xjh0

https://www.youtube.com/watch?v=gY5QldX3TN8

Learn about Instrument Assisted Soft Tissue Mobilization (IASTM) and how it can benefit your practice, save your hands, improve outcomes and prolong your career. Discussion topic includes definition, basic application, soft tissue healing principles, review of the literature and application in practice. We let you try dozens of instruments and tools to make your treatments easier and more effective – then you can choose the best option and make an informed decision. Stop with cookie cutter techniques and start critical thinking and application – including active mobilization therapies and functional rehab protocols. See how IASTM is an extension of your body that will give you renewed confidence in skills to use in practice.

Who should attend:

This course is open to massage therapists, athletic therapists, kinesiologists, physicians, physician assistants, chiropractors, physical therapists, physical therapy assistants, athletic trainers, and nurses.

Reference Text: Introduction to IASTM. Professional Health Systems Inc.

Learning outcomes:

Upon completion of this course participants will be able to…

… identify tissue specific structure (muscle, fascia, tendon, bone, ligament, nerve and viscera)

… review of current literature and contraindications, indications and application

… generate a list of indications, application and dosing protocols

… apply the basic evidence based outcome protocol

Step 1 – Functional range of motion (ROM) screen

Step 2 – Locate area of restriction or adhesion

Step 3 – Detailed muscle testing and palpation

Step 4 – Use instrument on specific adhesions and improve mobility

Step 5 – Re-Test to show yourself and the client the results!

… apply the appropriate IASTM treatment edge based on the target tissue and desired treatment effect

… discuss case study specific application in practice

… achieve better client results by identifying the true cause of pathology and working smarter not harder

Class format:

Hands on anatomy and palpation review (bone, ligament, joint, muscle, nerve, vessel, fascia)

Evidence based clinical integration of assessment with pathology and evidence informed treatment options listed below:

Efficient biomechanics - work smarter instead of harder to prevent injury and get better results

Assessment Orthopedic and neurologic testing – have an accurate clinical understanding of the patient-specific injury, compensation and dysfunction, differential diagnosis.

IASTM use of instruments and critical thinking to improve results and decrease clinician fatigue by specific tissue and body region – indications, contra indications, basic and advanced.